Relocating its headquarters to Abu Dhabi, U.A.E., not only makes Pure Salmon ideally placed to contribute to the emirate’s burgeoning aquaculture industry, it also gives the land-based Atlantic salmon farming company “the perfect geostrategic location” to manage, service, and support all of its facilities around the world, according to its chairman of Middle East operations, Christophe Lalo.

Pure Salmon announced last month that Abu Dhabi would be home to its global head office, and that through a new partnership with the Abu Dhabi Investment Office (ADIO), it would hire world-class talent and expand its operations.

With a focus on agriculture-focused technology, ADIO has set up a USD 545 million (EUR 461.3 million) innovation program that incentivizes companies to expand in the Abu Dhabi, the capital of the United Arab Emirates.

“Since late 2016, we have actually achieved many milestones on several fronts globally. Establishing Pure Salmon’s global head office in Abu Dhabi, thanks to the support from several U.A.E. government entities such as ADIO and the EAD [Environment Agency – Abu Dhabi], is indeed one key defining moment,” Lalo told SeafoodSource.

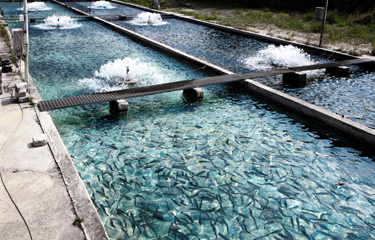

Pure Salmon, which is owned by private equity funds managed by Singapore-based 8F Asset Management, already has plans in place to develop recirculating aquaculture system (RAS) facilities for the full grow-out production of Atlantic salmon in Poland, France, Japan, and the United States, with the strategy of supplying these markets locally. Construction of these operations are all on track, Lalo said.

In February 2019, Pure Salmon revealed Tazewell County, Virginia, will be the location of its farm in North America, and in January 2020, it said it will build a 20,000-MT-capacity RAS facility in Bologne-Sur-Mer, France. Construction on both facilities is likely to begin in late 2020, with fish from those farms hitting the market in 2023. Additionally, in July 2019, it announced it will build a USD 250 million (EUR 224 million), 20,000-MT facility in Lesotho, a country close to South Africa’s major markets. And it has begun construction on a 10,000-MT facility in Japan, with the goal of having fish on the market by early 2022.

Furthermore, with the company’s overall ambition of producing 260,000 metric tons (MT) of salmon by 2025, the next phases of growth will consist of five facilities in China and one in Southeast Asia. Pure Salmon recently announced it had raised USD 61 million (EUR 52 million) from a global network of institutional, sovereign, and family office investors, with a goal of raising USD 120 million (EUR 102.4 million) to build out a 10,000-MT land-based salmon farm in Brunei. The facility is being developed in partnership with the Strategic Development Capital Fund, a Brunei government fund under the purview of the country's ministry of finance and economy.

Pure Salmon said it will distribute a mix of branded fresh and smoked salmon products to the Southeast Asian markets targeting traditional retailers, e-commerce platforms, and tourism-driven hotels, restaurants, and catering sectors in Thailand, Singapore, Indonesia, Malaysia, and the Philippines. It also plans to process its byproducts into branded pet food and treats.

Additionally, plans for a facility in Abu Dhabi are in the process of being finalized, Lalo said.

“The aquaculture ecosystem in Abu Dhabi is thriving,” he said. “Thanks to the support from several U.A.E. government entities such as ADIO and the EAD, and within the UAE 2030 Food Security Program, an impressive amount of effort and resources have been mobilized to support the development of the aquaculture ecosystem here in Abu Dhabi, and Pure Salmon is a perfect example. We have relocated our global HQ to Abu Dhabi and are continuously hiring seasoned aquaculture experts locally. We are also engaging with a local university to jointly set up an aquaculture RAS program to educate and train next-generation aquaculture experts in cooperation with [the] Pure Salmon Academy.”

Pure Salmon takes a “holistic approach” in its selection process for locating its RAS facilities, Lalo said.

“Our strategy in selecting the locations is to focus on countries and regions with high and strongly growing demand for Atlantic salmon, that currently import a significant portion of its local consumption, that are remote from conventional sea-cage salmon producers, and where the facilities can be built close to high population concentration zones,” Lalo said.

The company plans to import Pure Salmon products grown elsewhere into the areas where it plans to launch months before production comes online in order to begin familiarizing local consumers to its brand. Through its recent launch of a new salmon brand in French supermarkets, and its purchase of the aquaculture division of Krüger Kaldnes from environmental services firm Veolia in June, it now has more tools by which to expand its brand globally, 8F Capital Partners’ Yoram Layani told SeafoodSource in June 2021.

In regard to the fast-growing land-based salmon production space, with new projects announced on a near-weekly basis over the past year, Lalo said Pure Salmon has already distinguished itself from the mounting competition.

“The barriers to entry and success are very high,” he said. “Pure Salmon has already combined the many key success factors must that are critical to execute a successful and highly-profitable business in RAS salmon globally. Pure Salmon aims to tackle the global challenge of healthy and sustainable protein production while creating material positive social and environmental impacts and generating compelling returns for investors. For this purpose, [we are] using leading RAS technology to sustainably produce clean, fresh, traceable, and healthy Atlantic salmon close to end consumers, in an environmentally friendly manner.”

Separately, 8F also recently announced the hire of Peter Liu as its new CFO and COO. Liu previously held senior positions in the financial services and asset management industries, including as KKR’s CFO of Europe and itsCFO of Asia Pacific.

Photo courtesy of Pure Salmon