Seafood demand will diminish in the second half of 2022 amid persistently high production costs, according to new analysis compiled by the RaboResearch unit of Rabobank.

The “Global Aquaculture Update 2H 2022,” subtitled “On the Brink of Recession,” also reports that the profits of salmon and shrimp farmers are likely to decline from their recent highs, and that the remaining months of 2022 may be challenging for both sectors.

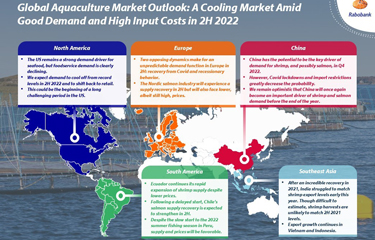

Authored by Rabobank Senior Global Seafood Specialist Gorjan Nikolik, the report states that recessionary dynamics have already started in both the European Union and the United States in the midst of their pandemic recoveries, and that this will lead to cooling foodservice demand and a reversion back to retail in both regions.

In the first half of 2022, the salmon and shrimp sectors both experienced record demand and prices. But thus far in 2022, the supply dynamics of each sector have bifurcated, with shrimp supply growth “strong” in 1H 2022 while salmon supply has experienced its largest contraction since 2016, at 6 percent.

“Both salmon and shrimp prices will correct from record levels,” the report found.

However, rising demand for imported seafood in China could potentially present an upside for both shrimp and salmon producers, especially in the fourth quarter, as long as the country does not reintroduce COVID-related lockdowns and import restrictions, the report said.

Regionally, seafood sellers in North America could be facing a difficult next few years, Nikolik said.

“The U.S. remains a strong demand driver for seafood, but foodservice demand is clearly declining. This could be the beginning of a long challenging period in the U.S.,” Nikolik said.

In Europe, the opposing dynamics of the ongoing recovery from the COVID-19 pandemic and emerging recessionary trends is creating market unpredictability, Rabobank said.

In South America, Ecuador continues to expand its shrimp supply, and Chile’s salmon supply is expected to strengthen in the second half of 2022 following a delayed start to the year, Rabobank found.

Southeast Asia is experiencing seafood export growth via surges in Vietnam and Indonesia, though India is struggling to match its production levels from the end of 2021 and the beginning of 2022.

Rabobank pointed to China as being the linchpin to stability in the global seafood market, so long China’s zero-COVID policy doesn’t interfere with its trading and markets.

“China has the potential to be the key driver of demand for shrimp, and possibly salmon, in Q4 2022. However, COVID lockdowns and import restrictions greatly decrease [that] probability,” Nikolik wrote. “We remain optimistic that China will once again become an important driver of shrimp and salmon demand before the end of the year.”

The report projects feed, freight, and energy costs will remain high and could increase further in the second half of this year. It notes the world’s salmon farmers enjoyed big profits through the past year-and-a-half, driven by high price levels, and it forecasts salmon prices will “partly normalize but remain high” through to the end of 2022. However, due to salmon’s long production cycle, higher feed costs have yet to be fully incorporated into the sector’s accounting, and these dynamics will combine to reduce farmer profitability, the report found. Nevertheless, the industry is still expected to generate healthy positive margins.

In contrast, if the world’s shrimp supply continues to expand as it did in the first half of 2022 or if demand further declines due to recessionary consumer behavior, Rabobank projects prices may fall below breakeven for farmers. In fact, in some areas of the global shrimp sector, this has already happened, Nikolik said.

“We remain optimistic about the long-term prospects of the shrimp industry but expect a challenging period in the short term,” Nikolik said.

Meanwhile, the global fishmeal supply remains relatively stable, though Peru’s fishmeal production is not expected to surpass that of 2021. Higher production in other parts of the world will not make up for lower production in Peru, according to Nikolik.

Fishmeal prices have risen over the past year, surpassing USD 1,600 (EUR 1,580) per metric ton recently, while high soy prices has brought soymeal to nearly the same cost. Record-high prices for vegetable substitutes are making marine ingredients relatively competitive in feed formulas, the report found, with the fishmeal/soymeal price ratio reaching a new low in May 2022 due to high soymeal prices.

Image courtesy of Rabobank