Miami, Florida, U.S.A.-based Blue Star Foods Corporation has announced a public offering on the Nasdaq Stock Exchange, with the goal of raising USD 4 million (EUR 3.4 million).

The company announced an underwritten public offering of 800,000 shares of common stock, at a price of USD 5.00 (EUR 4.32). The company also said it granted underwriters a 45-day option to purchase up to an additional 120,000 ordinary shares at the public offering price.

The common shares were approved for listing on the Nasdaq Capital Market under the symbol BSFC. As of the day of the offering, BSFC was trading at USD 6.72 (EUR 5.81) per share, and is now trading at USD 4.40 (EUR 3.80) per share.

The company said it intends to use the proceeds to “provide funding for general corporate purposes, including working capital, operating expenses, and capital expenditures.”

Blue Star Foods announced in April 2019 it was seeking acquisitions and investors. Since that time, it acquired U.S. crabmeat importer Coastal Pride Company and family-owned salmon recirculating aquaculture system company Taste of BC Aquafarms.

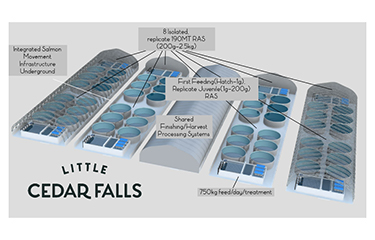

Since acquiring Taste of BC Aquafarms, the company announced the completion of a preliminary design layout for a USD 30 million (EUR 25.9 million), 1,500-metric-ton steelhead trout farm in British Columbia, Canada. Blue Star eventually expects to reach up to 21,000 metric tons of annual production at the site.

“We have a proven production system at our current facility that has continuously exceeded our design and production objectives and is delivering consistently repeatable results,” Taste of BC Founder Steve Atkinson said. “With this successful proof-of-concept as our basis, we are moving forward with confidence to develop the first salmon RAS designed from actual production outcomes. Our unique, modular approach will enable us to scale production to meet increasing demand and reduce capacity-risk.”

Photo courtesy of Blue Star Foods