Puerto Varas, Chile-based salmon-farming firm Australis Seafoods, which in 2020 launched the Southring brand to market its products globally, has signed an agreement with sustainable bioplastic producer BioElements to replace its conventional plastic containers and packaging with biodegradable material.

All of Southring’s fresh salmon fillets will now by exported in plant-based packaging developed specifically for the product, which has been certified for direct contact with food by the U.S. Food and Drug Administration (FDA), Australis said.

The move puts Australis “on the right path” and comes in addition to other environmental strategies the company has been taking, such as reducing its dependence on marine proteins and obtaining Best Aquaculture Practices certification for 100 percent of its salmon and Aquaculture Stewardship Council certification for 60 percent of its production, according to Australis Sales and Consumer Products Manager Jorge Andrés Goles. Goles said the move to biodegradable packaging makes Australis the first salmon producer to take this step.

“It is time to take a step forward in our commitment to the environment in industries such as aquaculture, which, although it is one of the driving forces of the national economy, also contributes to the production of plastic, which is the largest part and most persistent of marine litter, representing at least 85 percent of the total of this waste, according to the United Nations,” BioElements Project Manager Sofía Wolff said.

Wolff said the “harmless, light, flexible, resistant” packaging biodegrades completely in six to 20 months and said BioElements' bioplastic for packaging, film, and bags has been endorsed by the FDA, DICTUC in Chile, UNAM in Mexico, TUV in Europe, and the University of Rio de Janeiro. The registered B Corp is currently operating in Chile, Mexico, Brazil, Colombia, and Peru, with plans to open new markets this year. In 2021, its sales exceeded USD 30 million (EUR 27.6 million).

At the 2022 Seafood Expo North America in March, Australis launched its new brand, “Mama Bear by Southring” in an effort to target what it has identified as a high-growth market segment – families with children. It will initially market three frozen products: hamburgers, cubes, and portions.

“There are already advanced conversations with several [retailers and distributors], so we hope that consumers in the United States, Chile, and other countries will soon find the range of Mama Bear products in their favorite supermarkets,” Goles said at the time. Goles said Australis will market its products around the messaging that farmed salmon is environmentally responsible and has superior flavor, nutrition, versatility, and practicality.

The push for new packaging and branding comes as Chile’s environmental watchdog SMA announced charges against Australis for overproduction between July 2017 and March 2019 at its Morgan salmon center, located inside the Kawésqar National Park in the municipality of Puerto Natales, in Chile's Magallanes Region.

Australis is subject to penalties including a fine equivalent of up to CLP 3.4 billion (USD 4.2 million, EUR 3.8 million) for the infraction. The company said it was a result of an error made in the farm's production cycle, and said it would continue collaborating with authorities to resolve the issue. It said Morgan salmon center is no longer in operation, but while it did it always maintained aerobic environmental condition with optimal levels of oxygen as required by law.

Beijing, China-headquartered Joyvio Foods purchased Australis in 2019 for more than USD 921 million (EUR 847 million). According to Joyvio's 2021 financial statements, Australis recorded revenue of CNY 3.17 billion (USD 498 million, EUR 457 million) in 2021, an increase of 2.45 percent, and a net profit of CNY 83.2 million (USD 13 million, EUR 12 million).

It harvested 71,237 metric tons (MT) of Atlantic salmon in 2021, down 15 percent from the 84,132 MT harvested in 2020. The company also harvested 13,092 MT of trout, a drop of 38 percent from the 21,099 MT harvested in 2020. The company harvested no coho salmon in 2021, compared to a harvest of 2,978 MT in 2020.

Joyvio said the average harvest weight of its fish in 2021 was higher than the industry’s average primarily due to impacts of the COVID-19 pandemic and due to the postponement of a seedling-investment plan. This has resulted in a higher cost for fry than in the past, it said. Joyvio also said increases in grain and transportation prices have resulted in a knock-on impact on the price of feed, driving up Australis' costs.

Despite the profits from Australis, Joyvio reported a net loss of CNY 288.6 million (USD 45.3 million, EUR 42 million) in 2021. Overall, Joyvio reported operating income of CNY 4.59 billion (USD 720 million, EUR 667 million).

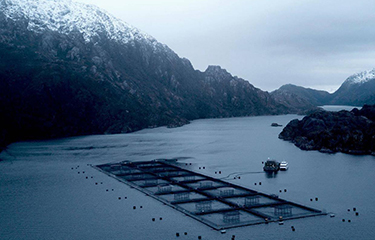

Photo courtesy of Joyvio Foods