The rise of green bonds, sustainability-linked loans, and other “green” financing options in the sustainable financing market will likely continue, according to analysts with large financing institutions speaking in a session during Global Seafood Alliance’s GOAL 2021 conference.

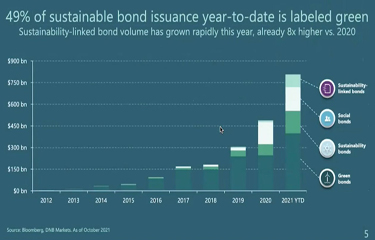

Since its inception, green financing has increasingly become a more mainstream offering in the global financial system. Since 2007, over USD 1.4 trillion (EUR 1.2 trillion) has been issued through green bonds, and other forms of sustainable financing, such as social bonds, sustainability bonds, and sustainability-linked bonds. And that trend accelerated significantly in 2020 and 2021, according to Oyumaa de Long, an associate of sustainable finance at Rabobank.

“Currently, we’re seeing a very big increase in sustainability-linked loans,” de Long said during GOAL's “Green Financing as a Tool for Sustainable Seafood Development” panel. “This means that a lot of issuers, a lot of companies, are implementing a sustainability element in their loan documentation.”

Part of that increase is related to heightened financial reporting requirements, with banks wanting to increase the amount of green loans in their portfolios, she said.

“Sustainable financing is really going to become the new normal,” de Long said.

Companies that have a focus on sustainable growth are increasingly becoming more attractive to lenders, she said.

“If you are a company that doesn’t do anything about sustainability, you are seen as risky and, in the long-term, less profitable,” she said.

For the seafood industry, green bonds and sustainability-linked financing are increasingly becoming a way to access capital for improvements to facilities, especially in the aquaculture industry, according to Global Seafood Alliance Strategic Advisor Per Heggelund. Part of that is related to third-party certifications, Heggelund said.

“A third-party certification like ... Best Seafood Practices also provides the enablement for seafood producers to obtain financing that verifies and improves their sustainability effort,” he said.

Eco-labels and environmental certifications require many points of data and key performance indicators (KPIs) that provide a ready-made blueprint for sustainability-linked financing, as many of the metrics that such financing requires are already being tracked, Heggelund said.

According to de Long, numerous seafood companies have realized their previous efforts to establish their sustainabiility credentials can be leveraged into additional financing using sustainability-linked financing.

“If you already have these KPIs in place, and you’re already measuring them, doing a loan using these KPIs is a little work for you, but is a great way to leverage your sustainability strategy by tying it to your financing,” she said. “We’re really seeing this spreading throughout all different types of sectors.”

Heggelund said green financing has become popular in the farmed salmon sector, with companies accessing billions in funding using sustainability-linked financing.

“This enablement in just the last couple of years has provided sustainable debt financing to the tune of USD 6.2 billion [EUR 5.3 billion] for the salmon-farming industry,” he said.

Mowi, Grieg, and SalMar have all secured significant financing in the past year. Mowi secured EUR 200 million (USD 231 million) in January; followed by Grieg securing NOK 1 billion (USD 118 million, EUR 102 million) in June 2020, and then a further NOK 500 million (USD 59 million, EUR 51 million) in November 2020. Then in April of 2021, SalMar secured NOK 3.5 billion (USD 415 million, EUR 358 million) in green bond financing.

The SalMar unsecured green bond was oversubscribed by NOK 1 billion (USD 118 million, EUR 102 million), and many green bonds end up oversubscribed by significant amounts, according to Heggelund.

Further incentivizing sustainability-linked bonds for the seafood industry is the fact that green financing for an aquaculture company ends up having a positive carbon impact many times higher than green bonds for companies like Apple, according to Manolin Co-Founder and CEO Tony Chen, whose company offers data services to the aquaculture sector.

“What you’re seeing in aquaculture is this money can be used to make significant impact,” Chen said.

The one drawback of the financing, DNB Senior Vice President Freyr Thordarson said, is that large green bonds and green bonds in general will likely only be accessible to larger companies – leaving out smaller players in the industry and those in developing markets.

“Cooperating on measuring data, collecting data, and analyzing data probably might make sense, but the issuance of an instrument such as a loan or a bond, there is either a single issuer or a joint issuer,” he said. “There is limited incentive for banks to offer a few loans here and there on the back of a cooperative information agreement.”

However, as the seafood and aquaculture industries continue to mature and consolidate, green bond opportunities will proliferate, Thordarson said.

“I believe that the seafood space will consolidate much further in the future, and by the consolidation alone the scale will build and the access to capital will increase,” he said.

Regardless, sustainability-linked financing is rapidly becoming a way for seafood companies to secure capital for big products, and sustainability measurement requirements are likely going to be the norm for future capital access, DNB Director Robert Christensen said.

“In the future, if you don’t have any sustainable profile whatsoever, I think it will be really hard to get some of the capital,” he said. “If you’re not showing some plan on what you’re going to do in the next five years, you’re going to start having trouble to get capital.”

Image courtesy of DNB